can you look up a tax exempt certificate

You can also search for information about an organizations tax-exempt status and filings. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data.

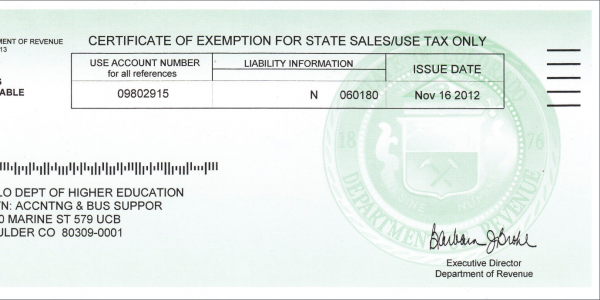

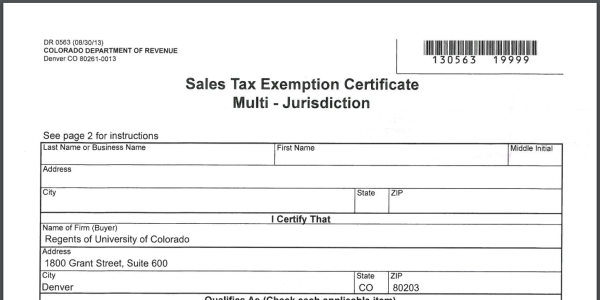

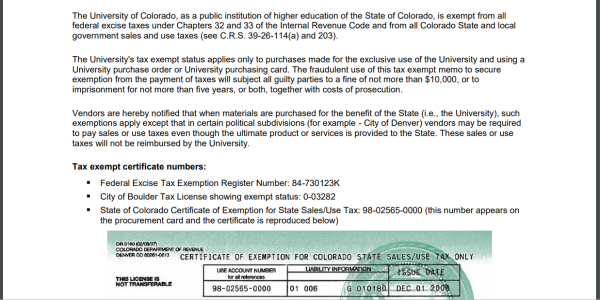

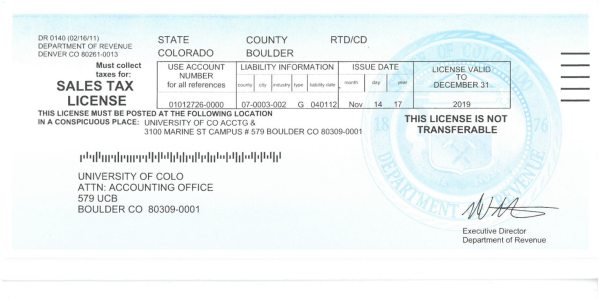

Sales Tax Campus Controller S Office University Of Colorado Boulder

Without it correctly filled out the seller could end up owing sales taxes that should have been collected from the buyer in addition to penalties and interest.

. This page includes links to the sample exemption certificates that are included in regulations and to the regulations themselves. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. Another way to check the tax-exempt status of a company or organization is to call the IRS directly at 1-877-829-5500.

You can also search for information about an organizations tax-exempt status and filings. Click here for a list of Direct Pay Permit holders. Many regulations include examples of exemption certificates that a purchaser might issue to a seller.

Enter the sales tax number s for verification. It is important to read the regulations to determine whether the sample exemption certificates apply to your transactions. Verification of a Diplomatic Tax Exemption card is available through the tax card verification database of the US Department of State.

Form 990-N e-Postcard Pub. Maintain copies of the certificates paper or electronic for three years. Can you look up a tax-exempt certificate.

Form 990 Series Returns. Alternatively an Excel template is available to complete and import. Tax Exempt Organization Search Tool.

Tax Exempt Organization Search Tool You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data. When you file through their website they keep a copy of your tax exempt form on your account so that you can access and print it at any time. Another way to check the tax-exempt status of a company or organization is to call the IRS directly at 1-877-829-5500.

A reinstated organization will have a. A certificate you have on file for an existing customer is invalid or about to expire. Method 1 Obtain a copy of your customers current Annual Resale Certificate.

The United States government or any of its federal agencies is not required to obtain a Florida Consumers Certificate of Exemption. Policy Services and Taxpayers Programs Unit URL. Exemptions are based on the customer making the purchase and always require documentation.

Steps for filling out the DR 0563 Colorado Sales Tax Exemption Certificate. Obtaining a 501 C does not guarantee that the organization is exempt for Missouri sales. Robert St Mail Station 6330 St.

Automatic Revocation of Exemption List. Step 1 Begin by downloading the Colorado Sales Tax Exemption Certificate Form DR 0563. Tax exemption certificates last for one year in Alabama and Indiana.

You may use the electronic certificate S-211E to claim an exemption from Wisconsin state county baseball stadium local exposition and premier resort sales or use taxes. Sales tax numbers may be verified using the Sales Tax ID Verification Tool available through the Georgia Tax Center. The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation.

On the Home page under Searches click on Sales Tax IDs. Yet no matter what the form looks like youre required to obtain a certificate when. Statewide group organizations might have one listing with All Branches as the city rather than a separate listing for each local chapter.

An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase. Please enter one of the following two pieces of information. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number.

The Department of Revenue recently redesigned the certificates the Department issues. 651-296-6181 800-657-3777 Unit Fax. An IRS agent will look up an entitys status for you if.

Certificates last for five years in at least 9 states. For example you cant buy copy paper and ask for a sales tax exemption because you. However obtaining a Florida Consumers Certificate of Exemption to present to Florida retail dealers makes it easy for selling dealers to document their tax exempt sales.

In order to access a copy of your original 1023 EZ form you will need to log in to your account click on My Account in the upper right-hand corner of the screen and then click on My Forms. There are different types of exempt organizations. How to Qualify for a Sales Tax Certificate.

To qualify to be exempt from sales tax the items you buy must not be used in your normal course of business. An IRS agent will look up an entitys status for you if you provide a name address and employer identification number. Sales and use tax certificates can be verified using the Tennessee Taxpayer Access Point TNTAP under Information and Inquiries.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt purchase. Form 990 Series Returns. Fully complete the information in tabs 1 through 4 before providing your vendor with an electronic copy of the certificate or a printed and signed copy.

Method 2 For each sale obtain a transaction authorization number using your customers Annual Resale Certificate number. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax. This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file.

Read the instructions and tips carefully. Different purchasers may be granted exemptions under a states statutes. Florida Illinois Kansas Kentucky Maryland Nevada Pennsylvania South Dakota and Virginia.

You may also review its determination letter posted on TEOS. The exact information needed to verify an exempt transaction varies by jurisdiction and the type of transaction. You can accept paper or electronic copies.

A 501 c is an Internal Revenue Service IRS exemption if you have not received an exemption letter from the IRS you can obtain Form 1023 Application for Recognition of Exemption by visiting their web site at httpwwwirsgov or call 877 829-5500. A new tax-exempt customer buys from you for the first time. If you hold a tax exemption certificate in one of these states make sure you renew as required to avoid.

You can search Pub78 data for 501c3 or other organizations eligible to receive deductible charitable contributions or the Exempt Organizations Business Master File Extract for other 501c organizations to find out if the organizations tax- exempt status has been reinstated. How long are tax exempt certificates good for.

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

How To Get A Resale Certificate In New Jersey Startingyourbusiness Com

How To Get A Resale Certificate In New York Startingyourbusiness Com

Do I Have To Pay Sales Tax What If I Am Tax Exempt Techsmith Support

Free 10 Sample Tax Exemption Forms In Pdf

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Printable California Sales Tax Exemption Certificates

How Do I Know If I Am Exempt From Federal Withholding

Sales And Use Tax Exemption Certificate Form 149 Tax Exemption Filing Taxes Tax

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

How To Get A Resale Certificate In Texas Startingyourbusiness Com

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Free 10 Sample Tax Exemption Forms In Pdf

Sales Tax Campus Controller S Office University Of Colorado Boulder

Free 10 Sample Tax Exemption Forms In Pdf

Form St 119 1 Download Fillable Pdf Or Fill Online New York State And Local Sales And Use Tax Exempt Organization Exempt Purchase Certificate 2009 Templateroller

Sales Tax Campus Controller S Office University Of Colorado Boulder

Sales Tax Campus Controller S Office University Of Colorado Boulder